Famous for its cascading hills, lush forests, charming yet quirky urban centers, and many waterways that brush the landscape with azure waves, the Pacific Northwest is undoubtedly one of the most scenic regions in the United States. The proof is in its national parks: among the greatest in the country, they showcase natural splendor at its finest, including pristine, untouched greenery and tremendous mountaintops that soar straight into the sky.

Whether you’re local to the area, an active traveler chasing new thrills, or simply a longtime lover of nature, each of the following four parks is sure to amaze. So strap on your hiking boots, grab your water, and get ready to scale these unbelievable mountainsides.

Sitting atop the Cascade Mountain Range in southern Oregon, Crater Lake National Park is home to one of America’s most stunning natural wonders. Formed by the collapse of an ancient volcano thousands of years ago, the brilliantly blue Crater Lake features clean, snow-fed waters that descend into astounding depths. In fact, it is the deepest body of water in America and also one of the world’s clearest.

There are many ways to experience all the majesty the park has to offer. You can take the Rim Drive route around the lake’s edge, which offers panoramic vistas from multiple vantage points, or embark on a boat tour to traverse its near-translucent waters. And don’t overlook the surrounding beauty: make time to hit one or more of the hiking trails that wind through dense forests, peaceful grasslands, and volcanic landscapes. With its breathtaking scenes and numerous recreational adventures, Crater Lake National Park offers an unforgettable experience you won’t find anywhere else.

The iconic Mount Rainier isn’t just any ordinary peak; it’s also an active stratovolcano and the tallest mountain in the region, standing at a whopping 14,410 feet. But you don’t have to scale all the way up to enjoy the best views. Rainier’s foothills boast other stunning sights at lower (and safer) altitudes, such as lush forests, diverse wildlife like deer and elk, and rugged cliffsides, making this park a haven for any outdoor enthusiast. For samplings of these ample attractions, venture along any of the many trails, such as the Skyline and Wonderland ones, which certainly live up to their names.

Mount Rainier National Park is a must-visit year-round, but it is especially worth the trip in the cooler months. During fall, you can bear witness to a myriad of reds, oranges, and yellows dotting the landscape before snow arrives in late October. Quickly after, the park becomes wrapped in a snowy blanket, welcoming visitors for activities like snowshoeing, skiing, and sledding. However you decide to enjoy your visit, come prepared to be awed by the majesty of this Pacific Northwest landmark.

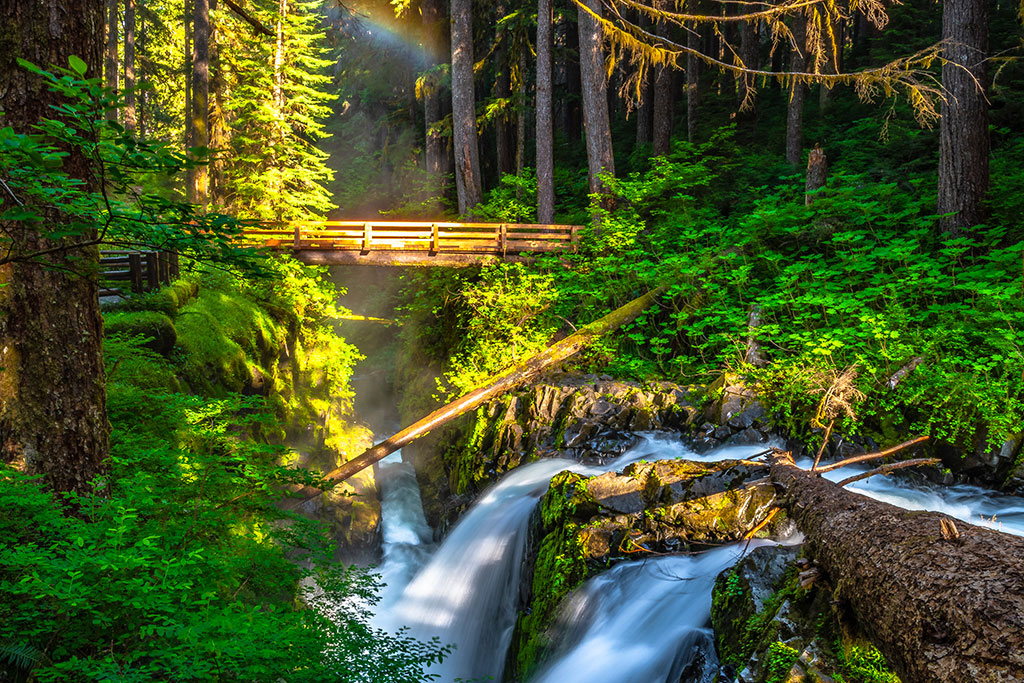

Nestled right in the heart of Washington’s Olympic Peninsula, Olympic National Park is a diverse and captivating natural wonderland of worldwide acclaim. In fact, it’s even a designated UNESCO World Heritage Site and Biosphere Reserve due to its unusual ecosystem. The park’s rugged coastlines are adorned with tide pools and sea stacks, or sculptural rock structures that rise from the water, while its dense, temperate rainforests—yes, rainforests in often chilly Washington—are blanketed in moss and ferns.

With such variety in landscape, you can experience multiple worlds in just a single adventure. Embark on scenic hikes through the park’s tremendous conifer trees, marvel at the cascading creeks and waterfalls that flow from deep in the Hoh Rain Forest, and meander the pristine Pacific Ocean beaches to savor their serene solitude. Anywhere you wander, you’re sure to spot outstanding views of the jagged Olympic Mountains soundtracked by the charming calls of birds like the winter wren that call these grounds home. With its relaxing nature walks and soothing natural scenery, Olympic National Park may tempt you to stay forever—or at least return once a year.

For a trek into the farthest reaches of the Pacific Northwest, set sail to Baranof Island on Alaska’s Inside Passage, a mountainous archipelago that even the most adventurous travelers may overlook. Certainly a hidden gem, Sitka National Historical Park provides a captivating tour through history, particularly the rich cultural heritage of the native Tlingit people. For instance, you can explore the park’s abundant trails to spot towering Tlingit totem poles, artistic and historic wonders that each tell a story of the indigenous people who have inhabited this landscape for centuries.

These trails immerse you in jaw-dropping natural views as well, especially the Mount Verstovia one; ascend from sea level up to the peak’s elevated heights for a bird’s-eye look at the surrounding waters. And be sure to make time for wildlife tours by boat, from which you can spot humpback whales, sea otters, and puffins in their natural habitats.

Acting as a perfect marriage of picturesque beauty and fascinating cultural enlightenment, Sitka National Historical Park lends a profound experience for visitors who want to learn more about Alaska’s fascinating past. However, those simply searching for a challenging hike and sojourn with nature will also find much to enjoy in this park, including glacier scenery that makes this one of the most soul-stirring examples of the Pacific Northwest’s stellar landscapes.

Whether you’re planning for retirement or preparing for a large upcoming expense, putting away money is a crucial step toward achieving virtually any short- or long-term goal. Unfortunately, one unavoidable essential can get in the way of this: spending. From rising grocery prices to substantial mortgage and debt payments, various costs can whittle away your paycheck soon after it hits your account, leaving very little for you to sock away for later.

What’s important to remember, however, is that not all spending is necessary—and, in fact, some of it could be downright wasteful if you’re not careful. If you’re eager to take better control of your finances, this guide can help you understand different categories of spending, identify where you may be overextending, and discover opportunities to save more money.

The term “spending” can generally be split into four categories: living, fixed, variable, and discretionary. The first two are the most essential and also eat up the most significant amount of your income. Living expenses include your rent or mortgage payments and property taxes, while fixed expenses encompass costs like loan repayments and insurance premiums. Though these vital costs may consume much of your funds, they are generally constant, making them fairly simple to anticipate when planning your monthly budget.

Next are variable expenses, or necessary costs that fluctuate based on market factors or your personal habits. Fuel, groceries, and utility payments are a few examples that fall under this category. Finally, you have your discretionary expenses. These are the fun purchases—which can also make them the trickiest to manage. They include entertainment, dining out, recreational shopping, and leisure travel and, like with variable expenses, will probably vary each month depending on your plans and inclinations.

Each type of spending has its purpose and degree of importance, so spending in itself isn’t the issue—it’s when we overspend that we can get into trouble. This term can be taken to mean prioritizing unnecessary expenses, either unknowingly or carelessly, over essential ones. It could also refer to engaging in spending patterns that interfere with your ability to save up for certain goals. And, of course, there’s the classic definition of simply spending beyond your means.

If you’re seeking a solution to your spending woes for any reason, you may be relieved to know there are many strategies that can help—here are four top ones to consider.

The best way to tackle your overspending is to start with the least necessary expenses: discretionary ones. Thankfully, these are also often the easiest to adjust. Review your past statements to quantify how much you’ve been spending in nonessential categories, then look for areas where you can make cuts, such as by eliminating streaming services or only dining out once per week. Consider using a dedicated budgeting app like PocketGuard to establish limits for your spending and get alerts when you’re approaching a preset restriction. Your bank or credit union app may also offer such features.

Of course, it’s one thing to set a budget for yourself and another to stick to it. To help solidify your discipline, it may be useful to reflect on the motivations behind your spending habits. For example, a common cause of discretionary overspending is social pressure; fashion trends and friends who engage in expensive activities may tempt you to splurge at alarming rates. Additionally, look out for any emotional triggers that tend to lead to impulse spending; so-called “retail therapy” can temporarily stymie negative emotions but also lead to destructive shopping. If you identify any driving factors you aren’t sure how to address, consider speaking to a therapist or financial counselor. With their expert guidance, you can put yourself on the path to improving your shopping mindset.

Another wise move is to assess your variable expenses. As with the discretionary category, evaluate your bank or credit card statements to identify spiking costs, such as for fuel or groceries, then use a budgeting app to help set limits where possible. If you’re struggling to stay within them, try price-cutting measures like meal planning or carpooling and turn to resources like Energy.gov’s Energy Savings Hub to find ways to reduce excessive utility costs.

Fixed and living expenses are more difficult to adjust, but it is still possible to address them. For instance, you could consolidate loans to reduce your interest rates or monthly payments. Or consider speaking to an insurance professional about cutting your insurance premiums, which may involve tailoring your existing policy or shopping for a new one.

Housing costs are even trickier to lower since doing so may require a more complex change like downsizing your home or refinancing your mortgage. These steps are certainly doable—particularly if you discuss your needs with a real estate agent or mortgage professional—but you may want to focus on modifying your discretionary and variable expenses first.

Prioritizing saving is one of the most effective strategies to reduce spending—after all, if funds are tucked away in another account, they won’t be available for you to use now. Consider adopting a strategy like the zero-based budget, which involves assigning every dollar you earn to a specific category, including savings. So rather than simply allocating funds for your living, fixed, and variable expenses and leaving the rest in your checking account, you would direct most of what remains into high-interest savings or other investments, apportioning only a small chunk toward discretionary funds. This approach helps make saving habitual rather than an afterthought and encourages you to take on new expenses only after you have satisfied your monthly savings minimum, enabling you to set stricter parameters for fun spending.

So how much should you be saving? It may vary depending on your specific situation and financial goals, but as a general rule of thumb, aim to earmark at least 20 percent of your income for an emergency fund, retirement savings, and other nest eggs. Even if this target seems unattainable now, what matters most is that you save something. Over time, you can gradually adjust your expenses until you can reasonably set aside 20 percent.

As you navigate the journey of improving your spending, keep in mind that you don’t have to go it alone. Consider reaching out to a financial professional or signing up for free budgeting courses online—these resources can assist you in establishing better financial habits and taking new steps toward ongoing fiscal wellness.

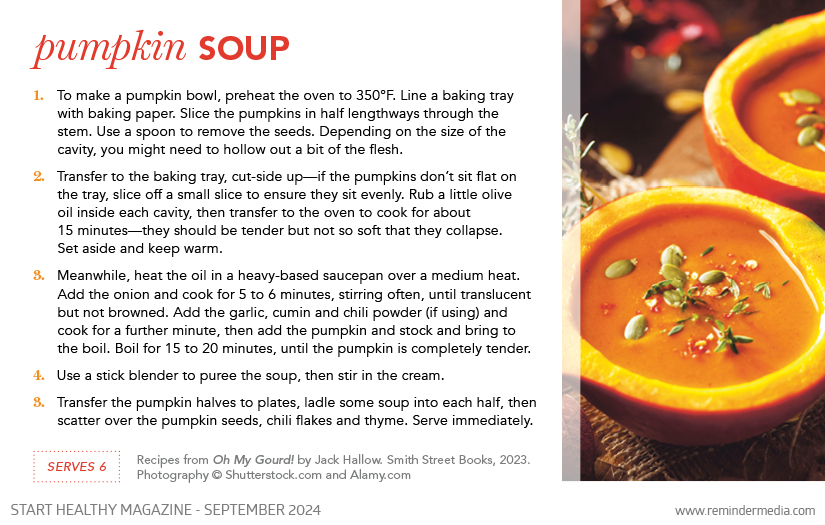

Nothing quite says “autumn” like pumpkins, an eye-catching fruit that is equally appealing in look as it is in flavor. This year, skip the usual store-bought selections and whip up these great-tasting recipes from the Oh My Gourd! activity book instead—rich and creamy, they’re sure to be the talk of your seasonal get-togethers.

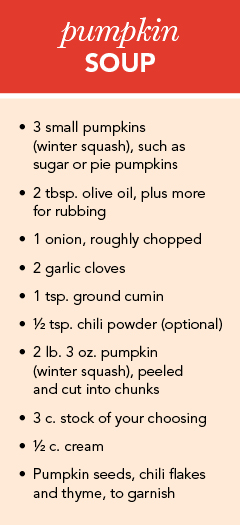

Family and friends alike will be amazed by this hearty soup that’s served in hollowed-out gourds.

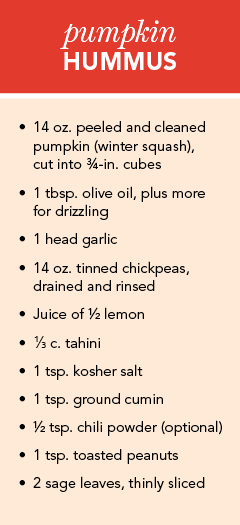

The traditional hummus base of chickpeas is infused with real pumpkin, making this smooth dip a perfect finger-food accompaniment for your fall table.

Recipes from Oh My Gourd! by Jack Hallow. Smith Street Books, 2023. Photography © Shutterstock.com and Alamy.com.

recipe by jack hallow

photos by shutterstock.com and alamy.com

The fountain of youth and the place I most want to dip my crouton: pumpkin soup is the GOAT of the Stew Culinary Universe. When served in a hollowed-out gourd, everyone’s favorite starter takes on a whole other dimension. Come on in, the soup’s fine.

Serves 6

recipe by jack hallow

photos by shutterstock.com and alamy.com

This silky hummus is prime for the dipping. Whether your weapon of choice is pita bread, fresh falafel, any manner of veggie stick or even the humble human finger, hummus is universal.

Makes about 2 cups

It doesn’t matter if you’re in your twenties or on the verge of retirement—having access to affordable health care can be vital to your happiness and well-being. Outside of employer-sponsored health insurance, there are two common avenues people typically take: the Health Insurance Marketplace or Medicare. If you’re planning to enroll in either option in 2025, follow these tips to help ensure that you’re fully prepared for what’s ahead.

If your employer doesn’t provide health insurance and you aren’t yet eligible for Medicare, you may be able to find affordable plans through the Health Insurance Marketplace at HealthCare.gov. (Note that some states have their own marketplace for enrolling in health care, which Healthcare.gov can direct you to as applicable.) As you follow the steps below, consider reaching out to your insurance broker, who can help you sort through the options to find the plan that suits you best.

Assess your medical situation

Evaluate your household’s medical needs, weighing factors like how often you go to the doctor and whether you may potentially require hospitalization or a specialist’s care. Also note which doctors you see and what prescribed drugs you take. These considerations can help you refine your search to health-care plans that provide your ideal coverage and include your preferred providers and prescriptions.

Determine your budget

Review your finances to determine how much you’ll be capable of spending on monthly health-care costs like copays and premiums. If your budget seems tight, look into ways you could potentially save, such as with the advance premium tax credit; this is an up-front credit based on your total estimated income for the year that can help reduce your monthly payments. (Keep in mind, though, that if you underestimate your income, you may have to pay back some of the credit come tax season.) Armed with a clear budget, you can better pinpoint a plan you’ll likely be able to afford.

Know your deadline

In general, the Open Enrollment Period is November 1, 2024, to January 15, 2025, though some states extend the deadline. To have your coverage begin January 1, you must enroll by December 15 of this year and pay your premium beforehand; if you sign up later than that, your coverage won’t be in effect until February 1. And if you miss the enrollment window entirely, you may have to wait a whole year to join. There are exceptions, however, such as if you’re eligible for a Special Enrollment Period due to a loss of health coverage, birth of a baby, or other qualifying circumstance.

Understand the plan types

There are four tiers of Marketplace plans: Bronze, Silver, Gold, and Platinum. Each level covers the same health benefits but has its own deductibles, premiums, and copays. For instance, Bronze plans have the lowest monthly premiums and the highest deductibles and copays, while Platinum plans are the opposite. Additionally, Silver plans are the only ones eligible for cost-sharing subsidies that may reduce what you’ll have to pay before your insurance takes over.

Beyond the tiers, you should also become familiar with the various types of health networks: HMOs, PPOs, POSs, and EPOs. The one you select may impact your costs and where you can get covered care. For example, HMOs tend to be budget friendly but require you to stay in network; conversely, PPOs offer the most freedom but tend to have more expensive premiums.

Final steps

As open enrollment nears, create an account at Healthcare.gov or your state’s health insurance marketplace. Doing so will give you access to comparison and filter tools to weigh the pros and cons of various plans, allowing you to be fully prepared once the sign-up process begins.

The Medicare program provides nearly universal health coverage for eligible individuals over sixty-five as well as those with certain qualifying health conditions. Like with Marketplace insurance, there are a lot of moving parts, so consider connecting with an insurance specialist for any questions or concerns you may have ahead of enrollment.

Identify when to enroll

Generally, you’ll be eligible to sign up for Medicare during your Initial Enrollment Period (IEP), a seven-month window beginning three months before your sixty-fifth birthday and ending three months after. Note that if your birthday lands on the first of the month, your IEP will kick off four months before you turn sixty-five and conclude two months after.

There are a few exceptions to these requirements. For instance, if you begin receiving Social Security benefits four months ahead of turning sixty-five, you will be automatically enrolled in Original Medicare (Parts A and B) on your birthday. Likewise, those who receive Social Security Disability Insurance will be automatically enrolled in Original Medicare after two years, even if they are not yet sixty-five. Use this online tool from Medicare.gov to determine when you may be eligible for Medicare.

You should start familiarizing yourself with the enrollment process and your options at least a year before your IEP to allow ample time to consider your choices so you don’t risk missing your window. It is possible to sign up after your IEP, but you may be stuck with higher premiums for the duration of your Medicare coverage. You can potentially avoid this if you qualify for a Special Enrollment Period, such as if you retire after sixty-five and need to enroll in Medicare once you are no longer covered by an employer insurance plan.

Know your coverage options

The most common way to receive Medicare is through Original Medicare. This includes Part A, encompassing inpatient/hospital coverage, and Part B, which covers doctor’s visits, preventative care, and other outpatient services. Most hospitals and doctors in the United States accept Medicare, and Part A is usually free for most policyholders.

Original Medicare enrollees can add a Part D plan as well, typically at an additional monthly cost, for assistance in paying for prescription drugs. Just be sure to sign up for it during your IEP, or you may be charged higher premiums.

The other main way to receive Medicare is with Medicare Advantage, also called Part C. You must enroll in Parts A and B to be eligible for this option and may have to pay an extra monthly premium. In return, though, you can get additional coverage for prescription drugs along with vision, dental, and hearing care, depending on your needs.

Beyond Parts A and B, there are other coverage options you can add, such as Medigap, which is designed to provide reimbursement for various out-of-pocket costs. You can explore these by typing your zip code into this Medicare plan-compare tool.

Final steps

The easiest and quickest way to launch your Medicare enrollment process is by creating an online My Social Security account at SSA.gov, where you’ll sign up for Original Medicare during your IEP. You could then enroll in a Part D or Medicare Advantage plan, if desired, at Medicare.gov.

Applying for health insurance can be a complicated process, so reach out to a specialist for guidance. Armed with their expert knowledge and your thorough preparation, you can head into the enrollment period with confidence, ready to get the coverage you need.