For most people, the end of summer means less time being active outside. However, the closing of the season doesn’t have to stop you from improving your health. This issue of Start Healthy is packed with tips to help you improve your mental, physical, and financial wellness in creative ways. From creating a natural oasis in your backyard to budgeting tips for all ages, you’ll find many inspiring health-related topics to read about.

Do you love seeing wild animals in your yard? If so, be sure to read about how you can turn your space into a Certified Wildlife Habitat. Steps like planting the right greenery and providing food and water can help you attract your favorite local birds, mammals, and other animals.

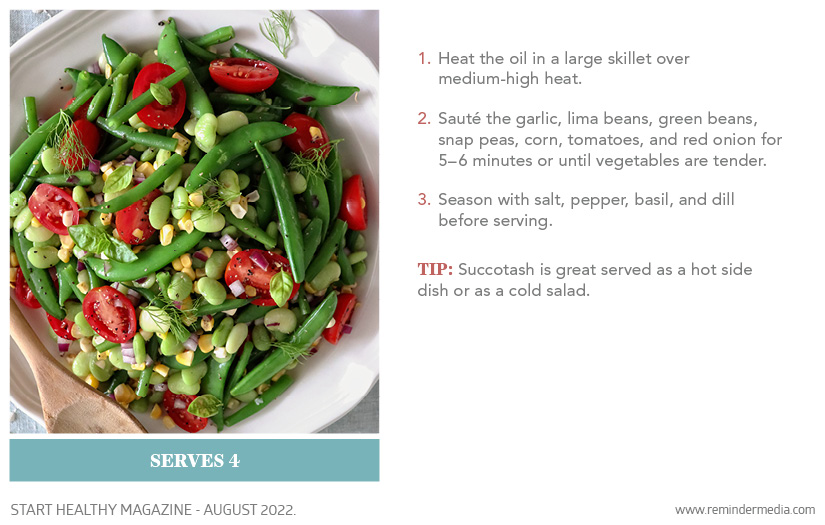

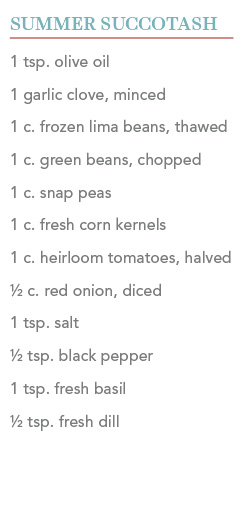

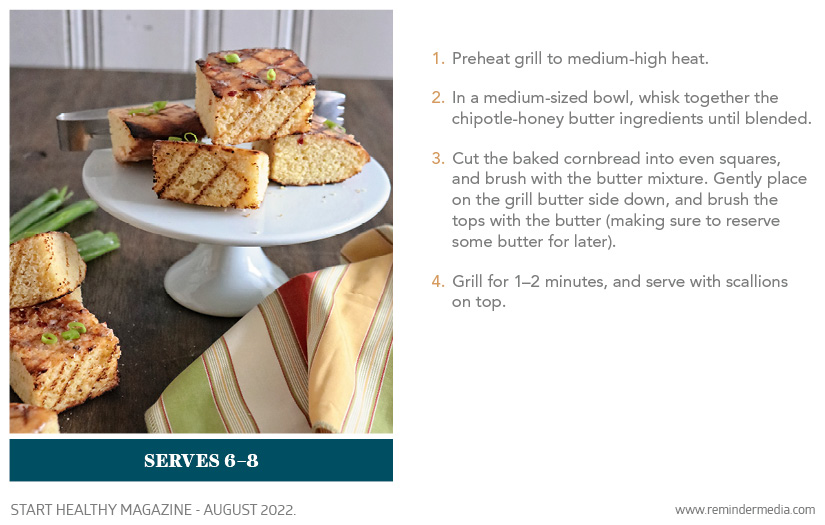

Another great backyard activity, barbecuing, is a must for August. The recipes inside for succotash and cornbread are the perfect accompaniments to your grilled foods.

It’s time to think about your healthy-eating plans for the busy fall ahead. A food-delivery service may be just what you're looking for. The enclosed guide can help you find the perfect services based on your budget, dietary preferences, and more.

Speaking of budgets, with vacation bills coming in and the holidays on the horizon, it’s important to revisit your finances come August. The tips inside can help you develop better budgeting habits based on your age group.

Here’s wishing you an amazing August! As always, it’s a pleasure to send you this magazine.

Imagine having your outdoor space filled with beautiful blooms and plants, colorful butterflies, and the delightful melodies of pretty songbirds. If you convert some of your yard into a place where creatures can eat, live, and shelter, this scenario can be yours. To create your own welcoming animal habitat, follow these tips.

Do yourself and the planet a favor by creating a refuge for pollinators and other wildlife. Your yard can be a beautiful space in which you can relax, and it can also be a place where local and migratory wildlife like birds and butterflies will be supported and protected. Once your refuge is complete, you’ll be rewarded with the pleasure of tending it and watching the animals that visit.

Customize your space so it is welcoming to the types of wildlife you’d like in your yard. For instance, if you’d like to welcome hummingbirds, put out bright-colored feeders for them, and if you want to attract bluebirds and chickadees, attach birdhouses to trees or posts. You can also fill your yard with native flowering plants for hummingbirds and crabapple and dogwood trees for bluebirds, cardinals, and robins. A small pond with a fountain could welcome dragonflies, frogs, and turtles and provide water for birds and other animals. If you put out the proverbial welcome mat, though, keep in mind that you may welcome all local critters into your yard, not just the ones you have intended.

The more welcoming your yard is, the more likely wildlife will visit it. Keep your cat or dog out of the habitat by fencing it in, and naturally prevent bugs and mosquitoes by planting citronella grass, lavender, or rosemary. Only use natural fertilizers like compost in your garden. You can help protect wildlife from predators by building a mini rock wall and planting a few trees and shrubs. Provide places for wildlife to rear their young, such as milkweed for monarch butterflies, or trees for nesting.

You can feed wildlife by adding bird feeders to your yard or by growing native plants that can produce berries, nectar-producing flowers, seeds, and fruit. Aim to provide food year-round by choosing plants, trees, and shrubs that bloom in the spring and summer for nectar and ones that grow berries in the winter. The Native Plant Finder tool on the National Wildlife Foundation (NWF) website can point you to plants that naturally sprout in your area and can feed local wildlife. Wildlife will enjoy a birdbath, pond, or even a bowl of fresh water, but be sure to refresh it often and keep it clean. You can give small birds access to the water by placing stones or small twigs in it for them to stand on.

Once you have your own wildlife refuge, you might want to get it recognized by the NWF as a Certified Wildlife Habitat. To qualify as a Certified Wildlife Habitat, your outdoor space will need:

You also need to use two to three sustainable practices in your yard or garden, such as mulching and limiting water use, planting less grass and using native plants, and fertilizing with compost and avoiding chemical fertilizers.

To have your habitat certified, you’ll need to provide information about it on the NWF’s website and pay a small fee. Your donation will help support the organization’s programs to protect wildlife. Once accepted, you will receive a certificate showing that your yard is a Certified Wildlife Habitat, and, if you’d like, you can also share your accomplishment by purchasing a sign to display in your yard.

Thinking ahead to the end of the season, do you have plans for Labor Day Weekend? The two recipes below are a must for your end-of-season picnics.

This recipe will help you enjoy the best summer vegetables in an appetizing and flavorful way.

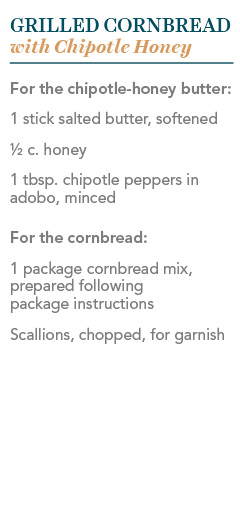

Don’t settle for plain cornbread! Make this recipe that is full of sweet and savory flavors.

recipe by patterson watkins

photos by patterson watkins

This classic corn-and-lima-bean succotash is full of fresh summer vegetables like green beans, snap peas, and heirloom tomatoes seasoned with fresh basil and dill.

Serves 4

Tip: Succotash is great served as a hot side dish or as a cold salad.

recipe by patterson watkins

photos by patterson watkins

This super easy summer side is a delicious addition to any barbecue party. Make sure to serve it with a little extra chipotle-honey butter—it’s just too good!

The meal-kit-delivery service industry is predicted to have a value of $11.6 billion in 2022. By 2023, online grocery shopping is expected to have increased by around 150 percent in the United States compared to five years earlier. Americans are subscribing to grocery and meal-kit delivery services in ever-increasing numbers. These services are often easy to use, offer a variety of options for dietary restrictions and eating preferences, and can even help consumers save money on their weekly grocery bills.

If you have yet to jump on the bandwagon, now might be the perfect time. As the busy fall season begins, having healthy foods and meals delivered to your door could save you time, money, and the hassle of planning what meals to make. Below are some of the most popular services available and the biggest benefits they offer consumers.

Thrive Market

This virtual grocery store had over one million subscribers as of April 2022. Shoppers can search for products in over ninety different lifestyle and dietary preferences, including Whole30, paleo, nut-free, family-owned, and fair-trade certified. Membership costs as low as $5 per month and includes a free gift with your first order.

Highlights:

Misfits Market

Billions of pounds of food go to waste each year in the US. Misfits Market’s goal is to reduce food waste and make high-quality foods more accessible by partnering with farmers and retailers to prevent the unnecessary disposal of “misfit” foods—produce and other goods that are perfectly safe to consume but do not meet the aesthetic standards of grocery stores. Subscribers can get a box of organic produce and other foods delivered to their door every week for as little as $30, and deliveries can be skipped or paused at any time.

Highlights:

Hungryroot

If you’re looking for a hybrid meal-kit and grocery-delivery service, then Hungryroot is for you. The company’s mission is to help you fill your pantry and fridge with healthy staples so you can create nutritious meals based on your skill level, time, and preferences. Subscribers can complete a simple quiz to get grocery and recipe recommendations or make specific selections for the produce and meals they want to be delivered each week.

Highlights:

Freshly

Most meal-kit services provide the ingredients and instructions and expect you to do the prep work. Freshly is different. Its fully cooked and never-frozen meals are delivered to your door weekly, and plans are flexible—you can get four to twelve meals per week for as low as $8.99 per meal. Meal choices range from vegetarian dishes like Farmstead Baked Lentil Pasta to heartier options like Protein-Packed Chicken Parm and Steak Peppercorn.

Highlights:

Sunbasket

It can be challenging and expensive to cook healthy and filling dishes, but Sunbasket makes the process a bit easier by delivering premade meals and meal kits right to your door. This service offers creative recipes, such as Five-Spice Pork and Eggplant Stir-Fry with Cashew Plum Sauce and Niçoise Salad with Seared Tuna, that you won’t find with many other delivery services. The company is also committed to sustainability and strict ingredient standards, so you can feel good about the foods you receive.

Highlights:

Factor

Fitness and healthy eating go hand in hand, but it’s not always easy to make time for both. Factor is changing the game by providing fresh, chef-prepared meals with good nutrition and its subscribers’ health goals as the top priority. Meals average six hundred calories, and subscribers are offered a free twenty-minute consultation with a registered dietitian upon signing up.

Highlights:

No matter your age, financial competency is an important skill to have. The most important part of feeling confident in your finances is your ability to budget—and that’s not always an easy task. Here are a few helpful budgeting strategies for every stage in life, which can help you save and spend your money in a way that suits both your lifestyle and financial goals.

Since money management isn’t always taught in school, it’s up to teens and their parents to discuss best money practices. The habits teens form now will stick with them into early adulthood, so use this time fruitfully in the following ways:

Track expenses

As an introduction to money, encourage your teen to keep an expense log. It can be as simple as a notebook with the item purchased, the date, how much was spent, and how it was paid for.

Open a bank account

It’s important for teens to start saving, so consider opening a joint account with your child. Introduce them to the basics of a savings account and how that money can be saved for a special item, emergencies, or an event down the road, such as college. Have them agree to a reasonable amount to put in their savings every week, month, or however often is feasible. You can also teach them that they can make their everyday purchases using a checking account. However, agree on a minimum to keep in the account.

Teach needs versus wants

Kids tend to say they need something that they just want, and it’s understandable because they’ve likely never had bills to pay. The distinction between the two will be important for budgeting. Have them think about what they need on a regular basis. Making regular payments for things like gas can help them understand what it means to take on more responsibility for their spending habits.

At the same time, they should know that spending money on wants, in moderation, is OK too. An easy way to do this for a teen is to have them put aside cash in a wallet and call it a “fun fund.” They can use the cash however they want for social activities, technology, hobbies, etc. However, resist the urge to monitor it. When the money is gone, they’ll learn that they should have used it more sparingly. Making small financial mistakes in an opportunity for teens to learn.

Moving up in the world! The beginning of adulthood can be an uneasy time financially. Life events like college, starting a career, buying a home, marriage, and having children can all put stress on a budget. With the basics settled, this is the age group that needs guidance on budgeting for the future.

Start investing

Dipping your toes into the world of investing can be intimidating. Apps like Robinhood make the process easy. Talk to a financial advisor, who can recommend easy ways to invest and diversify your portfolio in areas such as a 401(k) or an IRA. Investing as early as possible can help you have more money in the future for large expenses.

Save a third of your income

Having a salary or higher hourly wage can be exciting until you realize that taxes, bills, and savings chip into your check quite a bit. It’s a tough pill to swallow, but everyone goes through it—you’re not alone.

As a rule of thumb, put aside one dollar for every three dollars you earn so you can build a cushion for big purchases, such as a home and car payments. A good start would be to determine needs versus wants. For example, you can limit buying coffee out, unnecessary travel, and shopping and find ways to have fun that don’t involve spending money. Go for a hike, make new recipes with friends, or take up an inexpensive or free hobby like yoga, free online video games, or reading.

Shop for rates

When it’s time for you to buy a home, pick an apartment, buy a car, or do anything else that involves a loan, shop around for the best rates. High interest rates can hurt your budget and credit score tremendously, so it’s important to be patient and weigh your options before signing any loan agreement.

Adults who are in their thirties to sixties tend to be more financially secure. Your comfort level with money is better than that of a young adult, but you still need to be on top of your budget and investments.

Ask before you buy

It can be easy to think that since you have the money or credit limit for something, you should go for it. Instead, consult your spouse, family, or friends first. Ask them if they think it’s a reasonable purchase; they also might be able to help you find something just as great for less money.

Keep your spending under control

Having more income for everyday items like groceries doesn’t mean you need to spend more. Put restrictions in place for yourself, such as bringing only a certain amount of cash to the grocery store, so you only buy what you need.

Think about retirement

Saving for retirement should be a priority in adulthood. Think about ways to invest and beef up your 401(k) or IRA, but don’t solely rely on these accounts. If possible, put 10 to 15 percent of your pretax income into your savings account, and increase this by a reasonable 1 to 2 percent each year.

When you’ve made it to retirement age, it’s not the time to ease up on the good financial habits you’ve built over the years. There are decisions you’ll need to make to ensure your savings last.

Lower your expectations

The quintessential view of retirement is living on the beach, but don’t expect that. It’s not reasonable for most people to spend their retirement in a luxurious location. You should plan for fun, but keep it at a reasonable level. A great way to boost your cash flow so you can go on a more extravagant trip is to sell items you don’t need and downsize your home.

Check your money often

Don’t fall into the trap of feeling like you have endless funds. Be sure to check your accounts often, and have a discussion with your spouse, or whoever else has access to the account, about spending limits. Check with your bank to see if it offers spending alerts or other restrictions you can put in place as a gentle reminder to yourself.

Take advantage of discounts and government benefits

You might not feel like it, but you now qualify for senior discounts and government programs. This is something to be proud of, so take advantage of them! Discounts on dining, trips, and Medicare healthcare programs are crucial to help you cut back on monthly expenses (and some, such as those through AARP, can be used starting at age fifty).

Budgeting is a lifelong journey, so be patient with yourself and your money.