The advent of January offers abundant opportunities to move past the challenges of the year before and start fresh. This issue of Start Healthy offers essential insights and strategies to help you do just that, allowing you to kick off the new year with confidence and good health. Inside, you'll find a guide to family financial planning, a healthy take on two southern recipes, tips for lowering your medication costs, and a look at how birth order may impact individuals' personalities.

As a parent, you're always looking for ways to help secure your family's future, and one area to pay attention to is your finances. Read the practical advice inside on crafting a comprehensive financial plan that will help you both set clear, achievable goals and create a road map for how to get there.

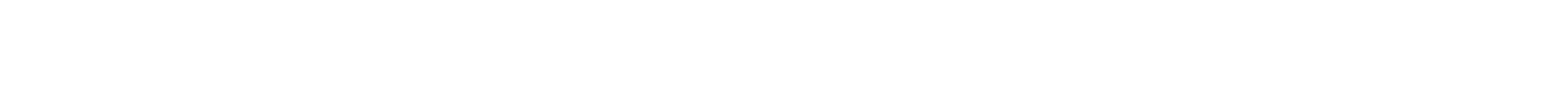

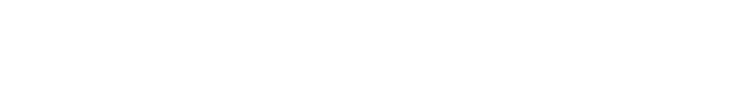

If you’re looking for healthier food options that don't sacrifice flavor, explore these revamped takes on two southern recipes. Serve up the chicken and portobello mushroom pot pie for dinner and the ginger cookies for dessert for a feast that is as wholesome and comforting as it is delicious.

Medications can be essential for maintaining your health, but their costs can also be a significant concern. The enclosed guide offers savvy strategies for reducing these expenses and making your prescriptions more affordable, ensuring that you stay on top of your well-being without breaking the bank.

While there's no definitive science on the subject, understanding the possible effects of birth order on individuals may offer valuable insights into family dynamics and personal development. Inside, dive into how sibling ranking can shape individual traits and behaviors, potentially impacting a person's academics, relationships, and even future career choices.

Here’s to a new year filled with health, happiness, and smart planning! As always, it’s a pleasure to send you this magazine.

As a parent, your hopes and dreams for your family are likely dependent on your finances. After all, aspirations like buying a house, providing a comfortable life for your children, and sending them to college can require a hefty amount of funds. By creating a financial plan, you can not only better prepare and save for these important milestones but also bolster your ability to safeguard your loved ones’ future.

The first step is to identify your monetary goals. Consider both short-term ones, such as buying a new sofa, and long-term ones, such as building a sufficient retirement account. By clearly defining your vision, you can better prioritize your spending and make more focused decisions to help you work toward your objectives. Be sure to note the amount of money you may require for each, overestimating a bit to give yourself some buffer room. Then review what you already have in savings to gauge how much more you may need to stash away. Once you have that information, you can establish a timeline and start taking the steps that will help you get there.

A well-crafted budget is the cornerstone of any sound financial plan—by tracking all your income and expenses, you can curb impulse spending and ensure that you prioritize saving for your goals. If you don’t already have a budget, download an online template or app like Honeydue to help you get started. Begin by identifying and categorizing essential costs, including housing, utilities, and debt payments, then set aside a modest amount for discretionary spending on takeout, entertainment, and other fun activities. What’s left is how much you’re able to put into savings; if it doesn’t seem like enough, you can try adjusting the other categories where possible to free up funds. Also, make sure to decide how much you want to apportion to each of your objectives based on their importance and timeline.

If you owe money, incorporate into your financial plan a strategy for paying it back; otherwise, you could wind up paying a substantial amount in interest and fees, hindering your goals. One effective tactic, known as the avalanche method, is targeting credit cards or loans with higher fees or interest rates first since those may cost you more in the long run. Or you could utilize the snowball method, which focuses on settling your smallest debts to start and working your way up to your bigger ones. Another option to explore is refinancing your loans, such as for your car or home, to get a lower interest rate so more of what you pay goes toward the principal. Any of these strategies may accelerate your debt repayment, ultimately freeing up more income for your financial goals.

It’s never too early to open a college fund for your child. Aim to stash away some money, no matter how little, for their education at least monthly. You could also enlist loved ones to contribute, such as by requesting a donation for each holiday or birthday. Just make sure to stow these funds in a separate account so they can remain untouched. A high-yield savings account is always a good choice to facilitiate higher earnings, or consider a 529 plan, which is specifically designed for college savings. Your money will grow tax-deferred, and then you can withdraw funds as needed for qualified education expenses without paying federal income tax.

It can be tempting to delay saving for retirement, especially if there are more pressing responsibilities. But this could have serious consequences in the long run, potentially placing a financial strain on your children to help care for you in your golden years. Even if you can currently only contribute a small portion of your paycheck to a retirement plan, doing so will ensure that your nest egg keeps growing over time; your employer may even match your 401(k) contributions, helping it build even more. You could also diversify your investments across stocks, bonds, real estate, and annuities to possibly maximize your savings. Consider consulting a financial advisor for assistance creating a personalized retirement plan aligned with your specific goals and risk tolerance.

Having adequate health, auto, homeowners, and life insurance can be essential for protecting your family’s savings should something unexpected happen, so be sure to have such safety nets and verify that their coverage is sufficient. Many parents tend to overlook life insurance in particular, viewing it as a nonessential expense while they’re relatively young and healthy. However, it can be crucial to supporting your family financially in case of your passing, replacing the income you provided.

Similarly, don’t neglect putting together your last will and testament, which can ensure that your assets transfer to your family with minimal time, money, and emotional effort required on their part. You can also add extra protections for your minor children by noting who should be their guardian and when they should receive any inheritance.

Creating a family financial plan may seem daunting, but it can be an empowering step toward establishing greater security. For help getting started, reach out to a financial advisor, who can assist you in identifying the right options for your circumstances and goals and answer any specific questions you may have. By taking charge of your finances in this way, you can build a firm foundation for you and your loved ones both now and for the future.

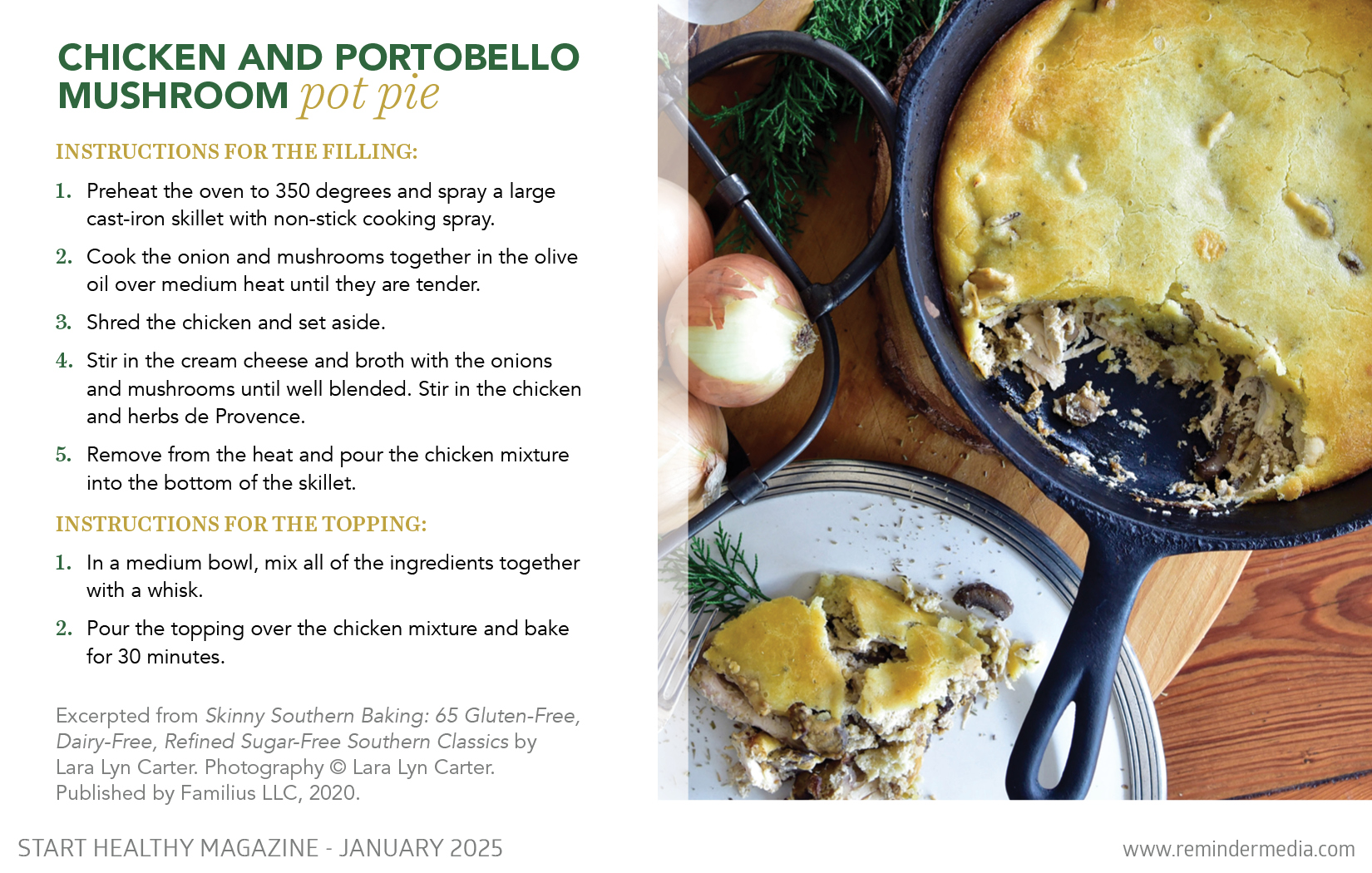

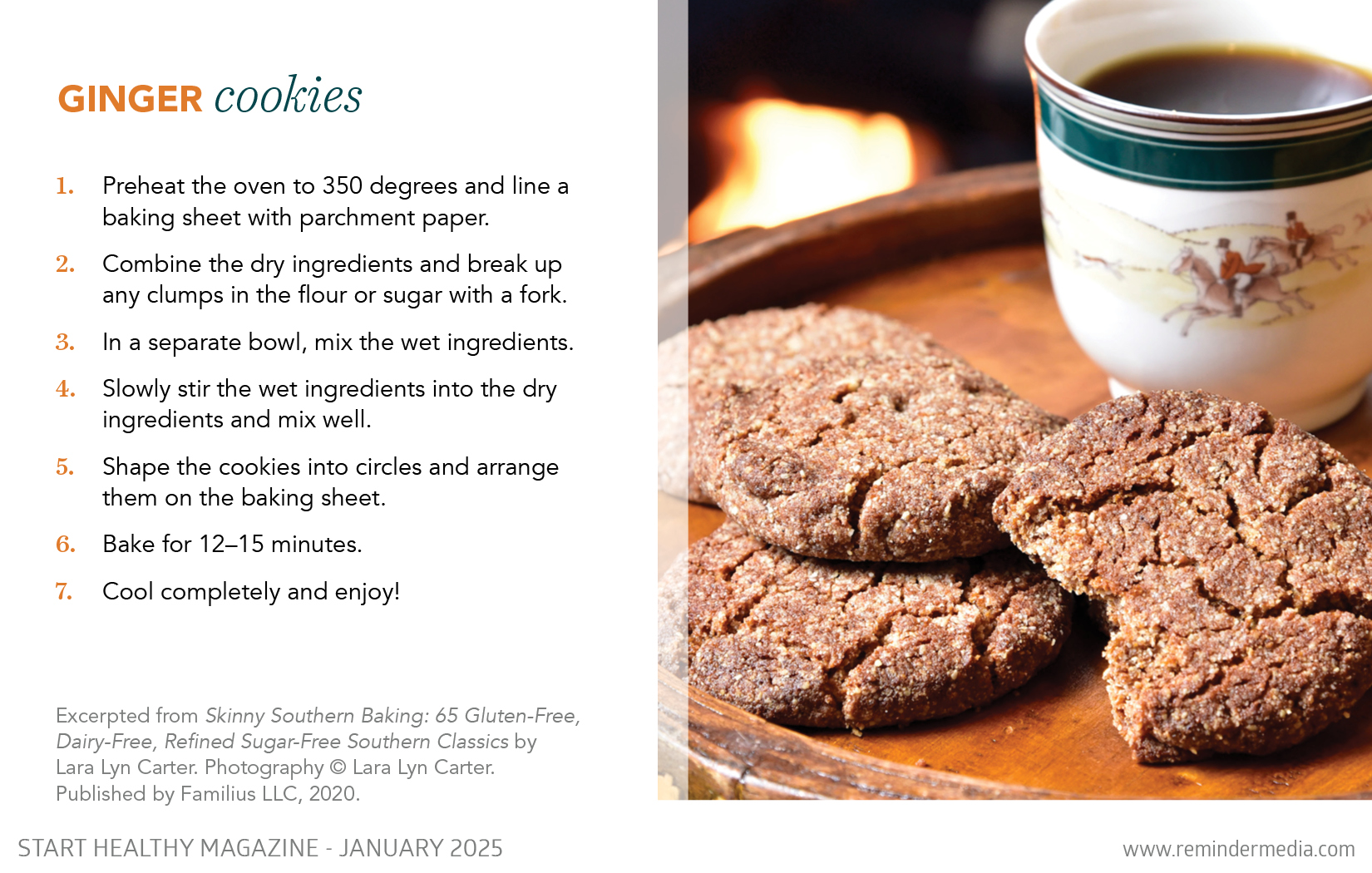

There is perhaps no better place to find comfort food that is as delightful as it is wholesome than the South. These two recipes from the Skinny Southern Baking cookbook capitalize on the versatility of southern cuisine to offer familiarity with a healthier twist, making them a must-try for home cooks seeking delicious and nourishing creations.

A true showstopper, this skillet dinner combines savory chicken and earthy mushrooms in a golden crust for a truly unforgettable dining experience.

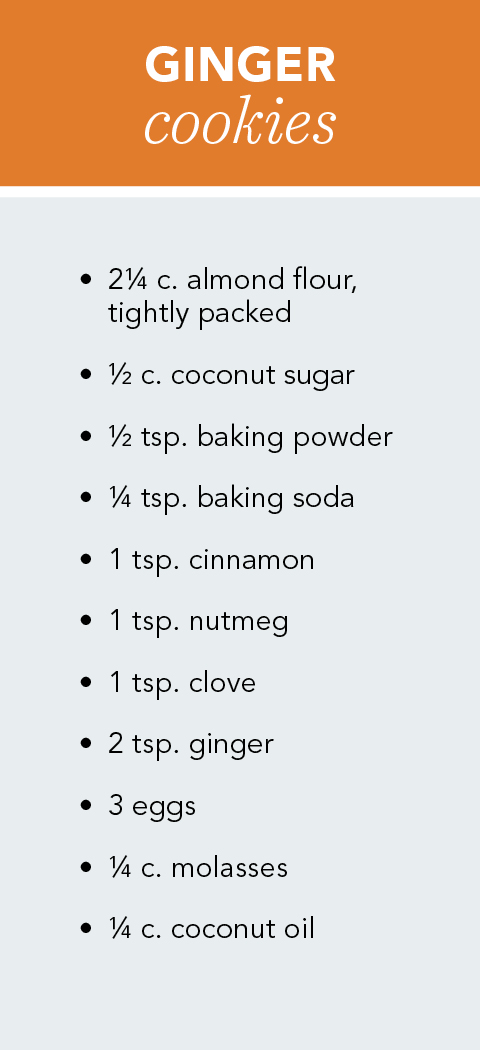

These aromatic treats offer a delectable almond flavor featuring a hint of molasses for added depth.

Excerpted from Skinny Southern Baking: 65 Gluten-Free, Dairy-Free, Refined Sugar-Free Southern Classics by Lara Lyn Carter. Photography © Lara Lyn Carter. Published by Familius LLC, 2020.

recipe by lara lyn carter

photos by lara lyn carter

When it comes to savory baking, I love to go for a comfort food that reminds me of my childhood. Forget peas and carrots and put a new spin on the classic with this recipe.

For the filling:

For the topping:

recipe by lara lyn carter

photos by lara lyn carter

These ginger cookies are soft, delicious, and full of the spices that warm us on cold days. They also freeze great, so make an extra batch and save them for a rainy day.

If you regularly take prescription drugs, you no doubt appreciate how they can benefit your health—and how their ongoing costs can quickly become a financial burden. Fortunately, there are numerous strategies and resources that may help you reduce your expenses. With this guide, you can take a more budget-friendly approach to your well-being without compromising your care.

Educating yourself about your health plan’s prescription drug coverage—whether it’s through your employer, Medicare, or a private insurer—is a good first step. Consult the drug formulary, or list of covered medications, on your insurer’s website to verify what is included along with your out-of-pocket costs. Some plans, such as the CHAMP Plan, don’t require a copay for many commonly prescribed drugs. In contrast, others use a tiered system that charges less for medications on lower tiers and more for those on higher ones.

While on your insurer’s website, also check whether it lists any preferred pharmacies. (Not all companies do so.) Filling your prescription with one of these partners may allow you to get your medications at a reduced price.

Your doctor can be a valuable ally in managing your prescription costs, working with you to explore cost-saving options as needed. For example, if you’re denied coverage for a medication, they may be able to provide a supporting statement confirming its medical necessity, influencing your insurer to reverse its decision. Additionally, discuss with your doctor whether there is a lower-cost alternative, including a generic version (more on that below) or a nondrug option. Though not effective in every situation, lifestyle modifications such as regular exercise or dietary changes may help manage certain conditions without relying on medication.

If you’ve been taking the same prescriptions for a while, consider asking your physician to conduct a medication review at your next visit, which could reveal several cost-saving opportunities. You may be able to switch from a pill to a lower-cost capsule, cream, or ointment, or a lower dose (at a lower price) might be sufficient. You might even find that you can drop certain drugs from your health plan altogether.

Doctors may sometimes prescribe a specific medication that can’t be swapped, but in many cases, a generic version can be just as effective. Regulated by the FDA, these drugs contain the same active ingredients and are as equally safe as their brand-name counterparts while also being up to 85 percent cheaper. As noted earlier, simply discuss this option with your doctor as an alternative to a pricier med to reduce your costs; your pharmacist may also be able to make this substitution for you.

For prescriptions you aren’t able to change, investigate whether you can purchase them in bulk, such as in a ninety-day supply. It will generally cost you more up front, but you may save money per pill. You will need to check with your doctor or insurer about whether you can purchase more than a month’s supply at once, though, since not all will allow it.

Exploring different pharmacies can further stretch your budget since prices can potentially differ significantly depending on where you go. If your insurer has a list of preferred pharmacies, start with those, but also feel free to shop around at other local ones in case they happen to be cheaper. Online pharmacies like Amazon Pharmacy and Sesame are other good potential options, as long as you take care to only buy from reputable sources; you can use the Safe Site Search Tool at safe.pharmacy to vet any you are considering using. And keep in mind that some online pharmacies have membership fees, so factor in those when calculating your expected costs.

Online discount programs offered by sites like GoodRx, NeedyMeds, and SingleCare can sometimes allow you to get your meds for less than you would through your Medicare or insurance coverage. For example, on GoodRx, you can enter your zip code to find participating pharmacies with discounted prices for a medication that might be lower than your insurance copay. You can then simply print the coupon and bring it to the pharmacy for your discount. Some of these sites also offer mobile apps for greater convenience.

Another helpful option is looking into whether your medication’s manufacturer offers a Patient Assistance Program (PAP), which may allow you to get your prescription at a reduced price or even for free. You can search the directory on the NeedyMeds website to see if there’s a PAP available to you. Many states also offer similar programs called State Pharmaceutical Assistance Programs (SPAPs), though you’ll want to check the eligibility requirements since they may vary.

In addition, if your health coverage is through a private insurer (and not through Medicare), you can use NeedyMeds to see whether the manufacturer of the prescription you require offers a copay card. This type of savings program can lower costs for certain meds, typically brand-name ones without generic alternatives.

Health care can be costly, but by following these tips, you can reduce the financial burden of your prescription medications. Reach out to your insurance professional to discuss your coverage and discover more ways to save, and always remember to consult with your doctor before making changes to your medication regimen.

Over the decades, people have been enthralled by the age-old debate on whether birth order has any real effect on human development. Alfred Adler, a trailblazing psychologist from the early twentieth century, is credited with the first theory on the topic, positing that our personalities are greatly shaped by our place in the family dynamic. His ideas set the foundation, but modern studies are more split on their relevance, indicating there may be more to it than basic overgeneralization. Even still, here are some of the possible ways birth order could make a long-lasting impact.

Firstborns have often been portrayed in popular culture as conscientious, responsible, and big achievers, and this stereotype may have some truth to it. These individuals tend to score higher on measured intelligence tests and demonstrate natural leadership abilities, developing a strong worth ethic and sense of independence from a young age. A huge factor behind this is the parents’ ability to give firstborns all their attention and effort; from helping with homework to setting strict boundaries and standards to engaging them in stimulating activities, they often have the time to go all in on setting their child up for success.

However, with this attentiveness may come some downsides. Firstborns may struggle with increased expectations and pressure to excel, leading to greater stress and anxiety about potential failure. And once a younger sibling comes along, they may be tasked, either explicitly or implicitly, with extra responsibility, whether it’s taking on more chores, setting an example, or helping care for their brother or sister.

All this can lead to adults who are go-getters and perfectionists willing to take charge and strive toward what they want, for better or for worse. Naturally, then, these individuals generally gravitate toward professions in management, law, and medicine, disciplines fitting for those with leadership and accomplishment-oriented tendencies.

Middle children sometimes feel, well, stuck in the middle: living in the shadow of their older sibling and envious of the special treatment given to the youngest. After their first kid, parents may become more lax this time around, making adjustments to rules they decide are too strict or unnecessary, and they don’t have as much time to give, having to split it between multiple kids as the family grows. This may lead middle children to feel invisible or neglected, potentially impacting their self-esteem. It’s why they can often fall victim to the stereotypical “middle-child syndrome” and become moody and rebellious—the former as a result of a sense of inadequacy or loneliness and the latter as a bid for attention.

It’s not all doom and gloom, though. Depending on the family dynamics, being in the middle may also lead to the development of valuable skills such as diplomacy, flexibility, and sociability. The first arises from taking on the role of peacemaker, helping to balance frustrations between siblings or even between a sibling and a parent. The second can come from learning to go with the flow of what other family members want, adapting to whatever the situation may be. And the last stems from building stronger relationships with friends as a way to get the support and attention they require.

Such abilities can lead to an adult well-versed in navigating complex interpersonal dynamics and life challenges. They may be particularly successful in a career in sales, human resources, or social work.

Generally speaking, parents are often at their most laid-back and easygoing with their youngest child in terms of rules and standards while also being the most coddling. This can lead to any number of positive and negative traits within such an individual. Since they may have fewer academic expectations placed on them than their older siblings, they can often become more creative, inventive, and entrepreneurial in both their studies and personal pursuits, seeking to make their mark in their own way. They may not be as worried about failure and more willing to take chances as they discover their identity, growing free-spirited and seeking out exciting, foundational experiences.

On the other hand, such privilege to explore may prevent them from developing essential discipline and resiliency, and they may even become rebellious in these explorations as a way to stand out from their siblings. Meanwhile, babying behavior from parents increases the odds of these individuals becoming dependent or spoiled, leading to an entitled attitude, sense of invincibility, and inability to complete basic tasks, from cooking on the stove to doing laundry.

Despite these potential downsides, youngest siblings overall tend to grow up to be outgoing, open to possibilities, and eager to try new things. They may be best suited for a career in the arts, entertainment, or even business development to support their creativity and out-of-the box thinking in whatever area interests them most.

Even though some birth order research ignores them, only children also tend to show distinct traits. Without siblings, they may get close attention, support, and resources from their parents throughout their childhood, which fosters greater development and, thus, greater degrees of maturity and responsibility. Usually, only children are said to be independent, self-assured, and concentrated. They may, however, have trouble with sharing and social skills, hence the “only child” teasing that comes along with the territory. Like oldest siblings, only children may be inclined toward a career in a technical- or health-related field where they can put their strong drive and take-charge attitude to good use.

Birth order can provide some fascinating hints about personality features, but it’s important to treat these generalizations carefully. Every person is unique, and their identity is molded by a complicated collaboration of environmental and genetic elements. Moreover, birth order effects can vary greatly depending on the size of the family. One with two siblings, for example, means there’s no middle child, while one with four would have two in the middle, completely changing the typical dynamics in drastically different ways. Further muddying the picture is the siblings’ gender and age differences and whether there are twins or triplets involved.

Because of all these factors, birth order should never be used as a conclusive determination of individual behavior. However, it may still offer insightful analysis into human personality and development. And by gaining greater understanding of what may shape us, we can move toward a more empathetic mindset together.