In the hustle and bustle of everyday life, insurance policies can often fade into the background. It’s not uncommon to autorenew them year after year, assuming that your coverage remains an adequate safety net to hold you and your loved ones up during times of need. But what if those nets have holes or, worse, aren’t there when you require them most? That’s why dedicating time to review the following insurance policies at the beginning of each year can be crucial to maintaining your financial security.

This type of insurance can help protect your loved ones and ease some of their burden during a major time of uncertainty. If it’s been a while since you’ve reviewed your policy, take the time to do so now, especially if you recently got married or divorced, had a child, bought a home, or started a business since these events can change your coverage needs. Make sure that the death benefit would provide sufficient funds to support those you would leave behind, such as by replacing the income you bring to the household or covering the care costs of an elderly parent. Also, be sure to update your beneficiaries if your situation has changed since you first selected them. If you don’t yet have a life insurance policy, this is your chance to search for the best option for you and your current lifestyle.

Besides protecting your home, a main benefit of homeowners insurance is that it covers the cost of replacing your personal items in the event of a loss. However, that’s only up to your selected maximum coverage limit. To ensure you’re always fully protected, you’ll need to regularly examine what you’ve recently bought or sold so you can update that limit accordingly. A simple way to do this is through a home inventory, which provides an accurate overview of your possessions and their overall value. Consider conducting one this month so you can better understand how your coverage needs may have changed.

Furthermore, if you completed any major renovations last year, such as adding more square footage or building a pool, you may need to update your coverage since doing so likely increased the value of your home. You may also want to purchase additional coverage for floods and earthquakes if you live in an area prone to these natural incidents; they generally aren’t offered on traditional homeowners insurance. Talk with your provider to discuss your needs and ensure that you have the right amount at the best price possible.

Because it is a legal requirement in forty-nine states, auto insurance is an easy policy to purchase and continually renew without thought, particularly if you don’t know what it entails or what coverage you really should have. The basic mandates, though, may no longer be enough for your needs. So if your commute, driving habits, number of covered family members, or vehicles have changed, take a closer look at your policy this month. You can discuss any recent updates with your provider, being sure to check for discounts you may now qualify for as well.

This kind of insurance may not be one you’re familiar with or think you need, but it’s a good safety net to have. An umbrella policy goes above and beyond your other ones, such as homeowners and auto, to provide additional coverage for incidents where you’re at fault or the cost is greater than your main policies’ coverage limits. It can help with injuries, property damage, lawsuits, and personal liability, giving you extra peace of mind in whatever areas you may need it most.

When reviewing your policies, don’t forget about your four-legged friend. Pet insurance can help cover the cost of medical care for your animal companion, including regular checkups and emergency visits depending on the policy. If you recently welcomed home a new pet, such coverage could be worth the investment; according to the North American Pet Health Insurance Association, the average annual cost for insurance covering both accidents and illnesses is $640 for dogs and $387 for cats. That may seem like a lot, but paying now can save you a great deal in the long run should your pet end up needing more extensive care.

Remember that insurance needs change over time, making it essential to regularly review your policies and coverage limits to ensure they’re still sufficient. If you’re uncertain about anything, consider seeking advice from an experienced insurance agent or broker, who can help you find the right coverage for you.

Whether it’s a homey tale of a grandmother’s arduously tested recipe—featuring ingredients no one would dare substitute—or a dour story of plastic-wrapped chemical concoctions coursing down a conveyor belt, there is a history to every food we eat. Dishes that seem endemic to America today once began as a spark in one person’s imagination or a culture’s collective culinary experiments. Here are some of the fascinating—and potentially clashing—origin stories of our country’s most celebrated fare.

Beginning with what is unquestionably a nationwide favorite, pizza can trace its origins to southern Italy. Picture it: Naples in the 1700–1800s, a flourishing trade city in the Mediterranean with a bustling working class in need of cheap, accessible food on the go. To satisfy the public’s hunger, informal restaurants and street vendors crafted rudimentary pizzas—flatbreads layered with some combination of tomatoes, cheese, and olive oil, plus toppings like garlic and anchovies. When Italy’s Queen Margherita visited Naples in 1889, she requested a version of the pizza we may recognize today, one made with soft, white cheese, tomatoes, and basil. As the queen’s order gained popularity, this once-peasant food captured hearts throughout Italy.

The first pizzas sold in the United States, meanwhile, may be attributed to G. Lombardi’s pizzeria in Manhattan, which developed a unique New York–style pie back in 1905. Its winning flavors have since made pizza a staple of the American diet.

This may seem like an obvious German import, but the greasy, steaming, messily topped hot dog as we know it today has an even messier history. For details, we must naturally seek the knowledge of the National Hot Dog and Sausage Council (NHDSC), which, despite its preeminence, can’t quite come to a single conclusion.

In one tale, the frankfurter was the work of Johann Georghehner, an inventive 1600s butcher who traveled to Frankfurt to promote his tasty new sausage recipe. Then again, the people of Vienna, Austria, a city locally referred to as “Wien,” assert that their predecessors popularized the “wiener” that eventually became the American hot dog. Bavarian street vendor Anton Feuchtwanger and his brother-in-law could deserve credit for inventing the hot dog bun in 1904 as an edible apparatus for holding scalding hot sausages, but you could also thank Charles Feltman, a German baker in Coney Island who sold dachshund sausages in milk rolls way back in 1871. As for the origin of the term “hot dog,” the NHDSC also offers many possibilities. Perhaps the most popular is that cartoonist Tad Dorgan coined it as a casual reference to the steaming dachshund sausages being sold at New York’s Polo Grounds.

Ultimately, the jury is out on who to credit for this food and its regional variations; several restaurants make claims to originating recipes such as the Chicago dog with its requisite pickle spear or the sloppy, Southern-style chili dog. This essential ball-game and fair food may be shrouded in mystery and rumors that dilute its true origins, but it’s nonetheless fun to speculate about who, where, and why this food shaped into the form we relish today.

Whether you call it a sub sandwich, hoagie, hero, or grinder—and don’t you dare order one using the wrong term in the wrong region—this handheld meal is a favorite of delis and even certain convenience stores nationwide. Because subs (the term I will settle on) are members of the sandwich family, they were technically born from the Earl of Sandwich, an eighteenth-century gourmand who enjoyed his servings of meat between two slices of bread.

But when Italians immigrated to America, they reworked sandwiches into long, soft-yet-dense “subs” stuffed with cheeses, veggies, and thin slices of cured meats. The most popularly believed originator of these sandwiches is Benedetto Capaldo, a shopkeeper who fed them to hungry naval shipbuilders in New London, Connecticut, sometime around World War II. “Once the sub yard started ordering five hundred sandwiches a day from Capaldo to feed its workers, the sandwich became irrevocably associated with submersible boats,” writes Sam Dean for Bon Appétit. However, this story is yet to be verified and may simply be an urban legend.

As for the sandwich’s many other names, they developed regionally and have some unusual origin tales. A fun example is the term “hero,” supposedly coined by a New York Herald Tribune food critic named Clementine Paddleworth, who found the sub sandwich so astoundingly large that “you had to be a hero to eat it.” A common myth goes that “hero” is the Americanized pronunciation of the Greek food “gyro,” but this meal featuring rotisserie meat and vegetables wrapped in pita bears little resemblance to our modern vision of a hero.

This party favorite is a frequent accompaniment to football games and parties, and it’s practically a requirement beside certain lime-flavored libations. Grab a corner of a chip, dip into the cheesy sauce, and capture your favorite toppings: beans, guacamole, salsa, or even shredded cuts of marinated beef.

The popular snack has roots in the town of Piedras Negras, Mexico. Back in 1943, Ignacio Anaya García, nicknamed “Nacho,” threw it together for hungry wives of US soldiers at the Victory Club restaurant. His delightful hodgepodge included totopos (fried corn tortilla chips), Colby cheese, and pickled jalapeños, which he baked until steaming hot. Though not an official restaurant dish (he was simply covering for an understaffed kitchen), García’s recipe soon became a local favorite known as “Nacho’s Special,” and it was eventually peppered into menus at Tex-Mex restaurants. In the 1970s, a businessman named Frank Liberto premiered this snack at Texas Rangers games; when he started selling them at Dallas Cowboys games a few years later, they hooked audiences across America.

To this day, Piedras Negras boasts of its invention—so much so that it hosts an annual Nacho Fest for locals and tourists alike. This tasty celebration invites diners to come and unite around a universal tradition, one that defies borders: indulging in delicious food.

With its myriad of forms and flavors, bread remains a universal symbol of nourishment and comfort. These recipes from Marie-Laure Fréchet’s cookbook Upper Crust perfectly embody the artistry of the staple, using it to elevate timeless and delectable dishes to new heights.

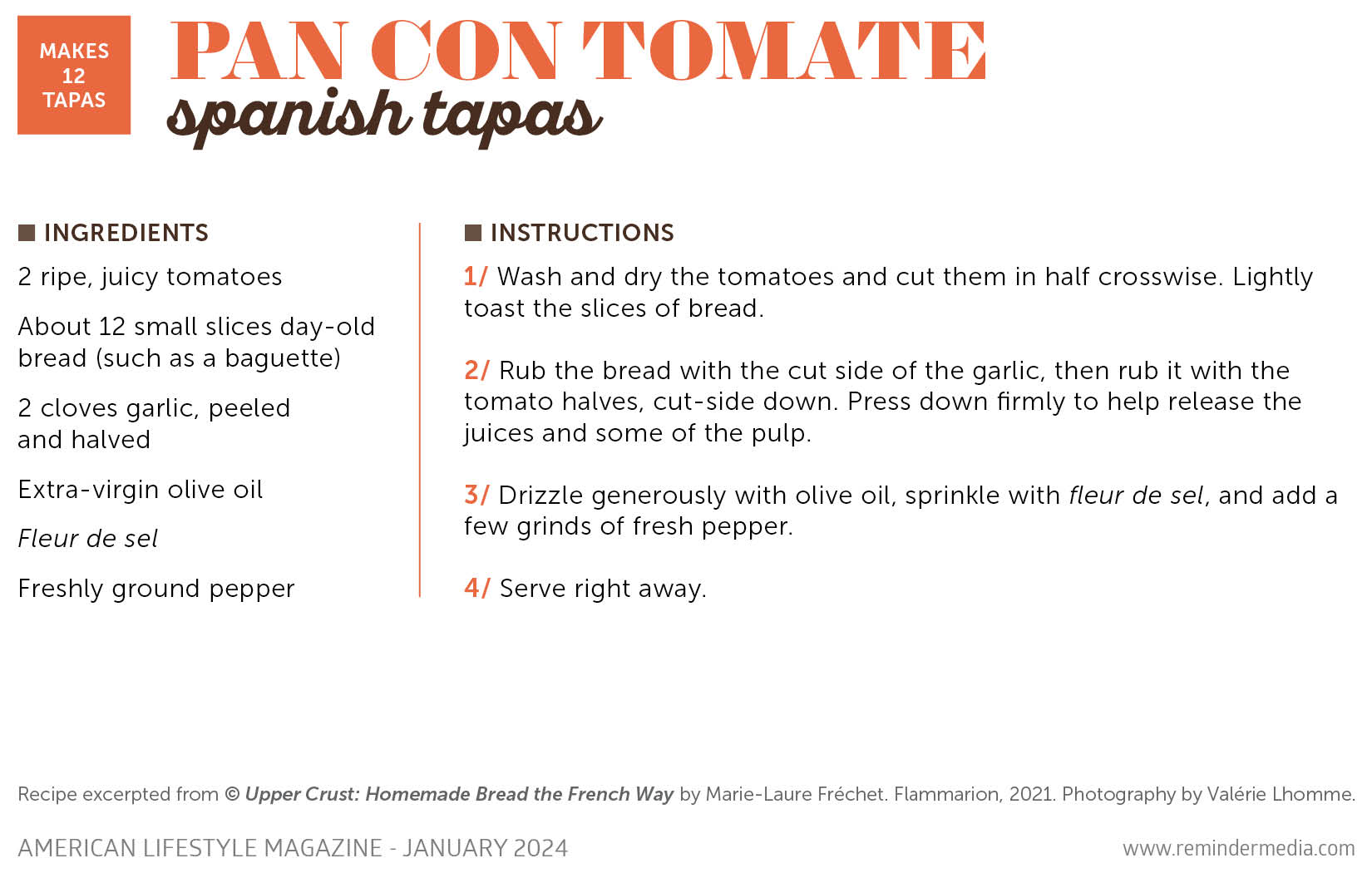

Simple to make and bursting with Mediterranean flavors, this Spanish tapas dish makes the perfect side to any meal or can be enjoyed as a tasty snack.

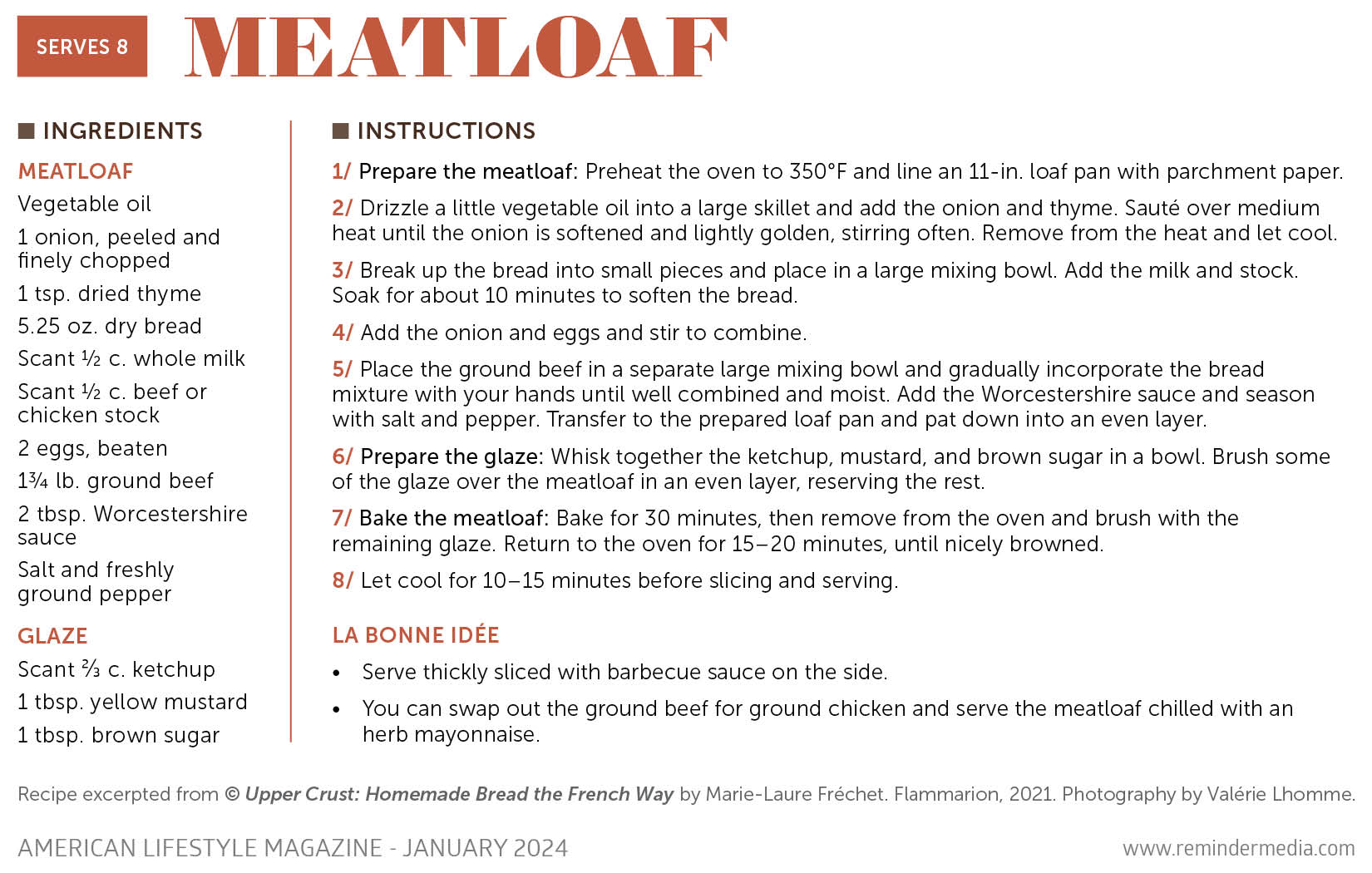

This quintessential comfort food is elevated with a glaze that infuses the dish with a burst of delectable flavors.

© Upper Crust: Homemade Bread the French Way by Marie-Laure Fréchet. Flammarion, 2021. Photographs © Valérie Lhomme.

recipe by marie-laure fréchet

photos by valérie lhomme

Juicy tomatoes meet crusty bread in these Spanish tapas, offering a burst of Mediterranean flavors. Infused with garlic and olive oil, they’re a delightful blend of simplicity and taste that’s perfect for your next gathering.

Makes 12 tapas

recipe by marie-laure fréchet

photos by valérie lhomme

Indulge in the ultimate comfort-food experience with this classic meatloaf recipe. Perfectly seasoned ground beef meets a mouthwatering glaze, creating a symphony of flavors that will leave your taste buds singing.

Serves 8

LA BONNE IDÉE

Ah, Paris in springtime, the cool Pacific Northwest in summer, and vibrant Vermont in fall. If you’d love to take your dream vacation or enjoy multiple excursions this year, use this guide to help determine what you can afford and how to get the biggest bang for your buck.

One of the first steps of travel budgeting is identifying where you can pull cash from, which involves evaluating your general budget and current spending habits. For instance, if you use the 50/30/20 rule—where you designate 50 percent of your after-tax income for needs like housing and food, 30 percent for wants, and 20 percent for savings or debt payments—your travel budget could come out of that “wants” portion. As for how much you should set aside, many people spend about 5 to 10 percent of their yearly net income on their vacations, but there’s no hard-and-fast rule. Weigh your priorities and other spending desires; after all, you might want to reserve some fun money for other interests like entertainment and shopping so you can sprinkle in local fun while anticipating your vacation.

Once you know what’s feasible to put toward your travels, consider opening a separate bank account to save your funds in. Doing so will help prevent you from using these savings for bills and other expenses; it will also make clear exactly how much you have available to spend while on vacation. If you typically charge your travels on your credit card, this will better ensure you don’t overextend your budget and take on too much debt, which could potentially damage your credit score and impede your chances of traveling in subsequent years. Just be sure to pay your balance off right away to dodge extra fees that could eat into your vacation funds.

After your financial strategy is in place, you can set your travel priorities for the year. Do you want to go on one big vacation, jet to a dream destination or two, or travel many times throughout the year? Knowing your objectives will help you determine how to best use your vacation savings. For instance, if you only want one major trip this year, you can allocate your entire budget toward it. But if you’d rather enjoy several different getaways, you may need to make price-cutting decisions about locations and dates so you can stretch your funds as much as possible.

If you feel that your travel budget is too restrictive for your vacation goals, look for ways to augment it by limiting other areas of your spending. Perhaps you could brew your own morning coffee and pack your lunch, cancel one of your streaming services, or work out at home instead of at the gym. Tightening your purse strings even just a little can add up—for example, if you spend $15 less a day, you can save about $450 extra a month. Considering that the average American forks out almost $13 per food-delivery order in fees alone, you might not find it too hard to restrict your spending in other areas to beef up your vacation funds.

As you plan, consider creative ways to cut costs to better meet your travel goals. For instance, you could make economical road trips to less expensive small-town or rural destinations, skip traveling weekends or during other peak travel periods, and avoid last-minute premiums by booking in advance. Try sites like Kayak and Airbnb to find deals on destinations, hotels and rentals, and airfare, and don’t forget to factor in extras like event tickets, cab fares, and tips, which may impact what activities you decide to do.

Travel insurance may be a worthwhile expense if your itinerary involves several prepaid and nonrefundable expenses because it can help you recoup at least some of your losses should your plans fall through. Expect it to cost up to 6 percent of your trip’s price tag.

No matter how tight your budget may seem, your travel plans don’t necessarily have to be out of reach. By keeping a watchful eye on your spending, researching ways to stretch your vacation dollars, and making creative choices about where and when you travel, you can make your dreams a reality.